Do you worry that your buyer may be over paying for a property in some competitive offer situations? It’s a real risk and it’s called The Winner’s Curse. Buyers can fall victim to The Winner’s Curse in negotiations when they over compete (and overbid) for the property in pursuit of a “victory” in the pressure of the negotiations.

I know from my experience as a listing agent in central Toronto and from our clients in markets across the country that in many cases, the highest bid in multiple offers is significantly higher than the other offers.

This can occur for a number of reasons: perhaps the buyer is under undue pressure, they could be getting poorly advised, money may not be a concern to them, they may be willing to overpay for a unique property or they may get so caught up in winning the process that they lose track of the value.

It is our job as REALTORS® to ensure that our clients are making the very best decision for them. If we sense that they may be falling victim to the winner’s curse, we should be able to communicate this with them in a way that still allows them the autonomy to make the best decision. Talking them out of a house they love could be just as unethical as allowing them to overpay. This causes a bit of an enigma for the agents but this article from the Program on Negotiation at Harvard Law School sheds some light on this important subject.

The authors suggest that by considering whether the purchase is a private-value asset or a common-value asset, we can determine the best negotiation strategy.

In real estate, a private-value asset would be a property that had unique value to that buyers. Perhaps it is next door to a family member, maybe it is the only five bedroom house in the neighbourhood, perhaps it has unique architectural elements that have meaning to the buyers. This private-value may make it worth more to this buyer than market value. If the buyer plans to enjoy the home for many years, this is likely more valuable to them than the extra money they may have to pay to obtain it.

Alternatively, a common-value asset in real estate would be a commodity condominium or a home in a suburban subdivision with few or no unique characteristics. It could also be any property that is considered primarily an investment for the buyers as opposed to a home. In these cases, it is likely undesirable to pay more than market value.

In general, buyers need not fear the winner’s curse if they expect to derive special benefits from the property. To avoid the winner’s curse? Have your buyers ask themselves a simple question: “Would you feel comfortable making this offer if you knew that all other bidders value the asset less than you do?” If the answer is yes – go get them the home of their dreams!

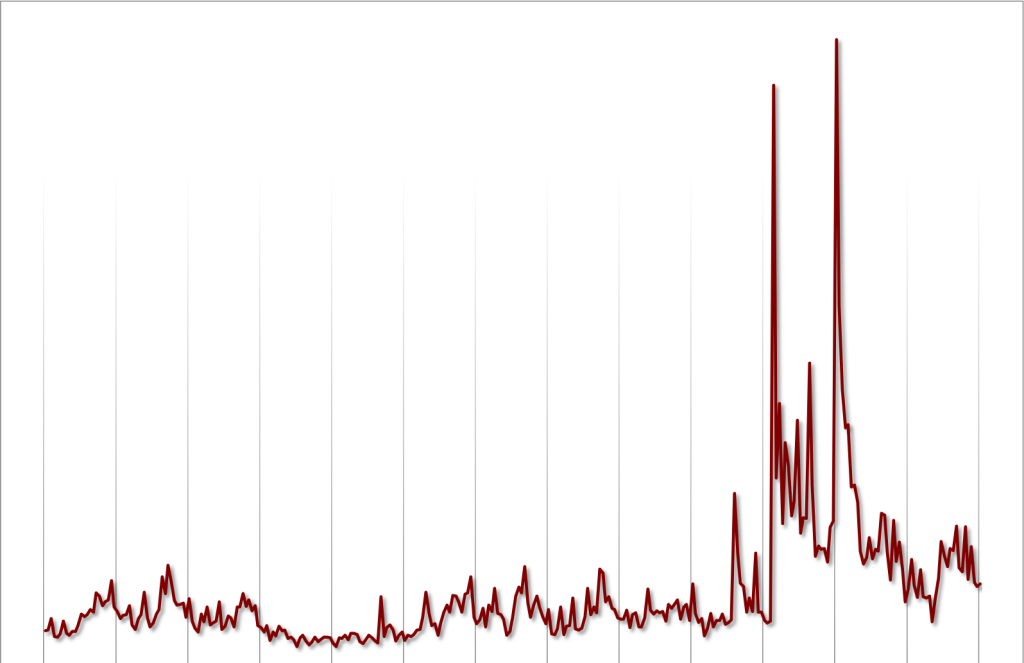

A Note on Market Value

Market value is defined as:

So, market value is not what the last property sold for although that may give us some valuable information on estimating market value. Estimating market value in a strong sellers’ market is tricky but important. It will likely be more than the last sale but likely not at the spiked level that we sometimes see properties fetch.

If it is your buyers that are paying that spike, be sure the property is truly worth it to them.